By Ishwari Chan

The overall size of the Indian financial services sector in 2021 is estimated at $500 billion, of which, the FinTech market comprises $31 billion, according to a report by BLinC Insights. The rapid pace of growth in the FinTech sector in India comes on the back of accelerated digitisation in the country, the report added.

In the next five years, the FinTech sector is expected to grow with a compound annual growth rate of 22%, and it currently stands as the third largest FinTech ecosystem in the world, behind the US and China.

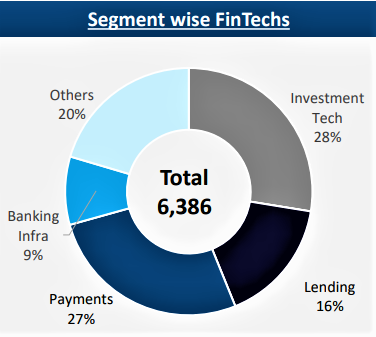

Of the total 6,386 FinTechs, 28% are into investment tech, 27% into payments, 16% into lending, 9% into banking infrastructure, and 20% are into other fields, the report said.

Advt Source: BLinC InsightsCurrently, the Indian FinTech industry has 10 unicorns, including Razorpay, CRED, Pinelabs, Policybazar; 52 soonicorns, which includes Ni, Lendingkart and Mswipe; and 170 Minicorns across all segments.

Source: BLinC InsightsCurrently, the Indian FinTech industry has 10 unicorns, including Razorpay, CRED, Pinelabs, Policybazar; 52 soonicorns, which includes Ni, Lendingkart and Mswipe; and 170 Minicorns across all segments.Also read : Indian Soonicorns: 15 FinTechs set to join the Unicorn club in 2022

Funding

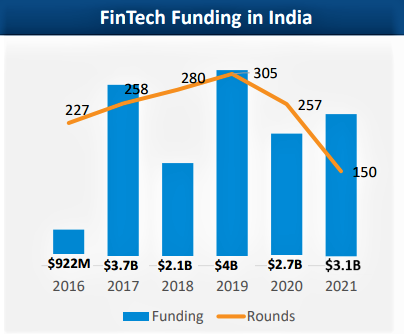

From 2016 to 2021, the total FinTech funding stood at $16.5 billion, from which around 60% was in the last 3 years.

In 2021, the funding received by digital payments was at $0.9 billion (43 rounds), digital lending stood at $0.73 billion (62 rounds), and that of investment tech stood at $169 million in 2021 (36 rounds).

For insurtechs, funding stood at $512 million (34 rounds) - a massive rise from $291 million (380 rounds) in 2020. Similarly, the one received by neo banking rose to $159 million in 2021 (15 rounds) from $33 million in 2020 (9 rounds), and that of other banking solutions was at $476 million (32 rounds) from $68.6 million in 2020 (33 rounds).  Source: BLinC InsightsAccording to the report, 37 companies operate in the $100 million to $1 billion funding range, 144 in $10 million to $100 million range, 263 in $1 million to $10 million range, and 339 below the $1 million range.

Source: BLinC InsightsAccording to the report, 37 companies operate in the $100 million to $1 billion funding range, 144 in $10 million to $100 million range, 263 in $1 million to $10 million range, and 339 below the $1 million range.

The report further states that 90% FinTechs he not raised funds till date, majorly due to lack of quality mentorship and/or functioning in a space, which is yet to receive traction from the investor community.

Advt OverviewGlobal FinTech market is growing at the rate of 23.4 % on year. However, India still remains an untapped market due to lower penetration of financial services. According to the report, 14.6% of the Indian population remains unbanked compared with that of 6% in the US. Only 20% of the SMEs he credit access, while insurance and mutual fund penetration continues to be low.

These untapped opportunities combined with high internet penetration, expanding middle income and high income households and forable government initiatives create large growth potential for Indian FinTechs, especially across digital lending, insurance and neo banking, said the report.

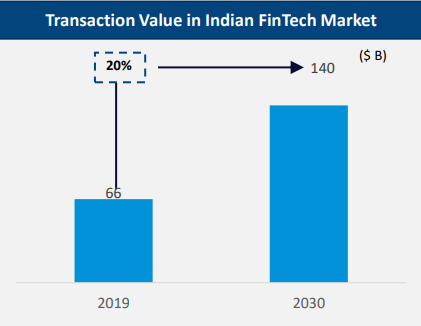

Advt Source: BLinC InsightsDigital lending is expected to grow faster, with stricter regulations with an expected CAGR of approximately 33.5% by 2023, insurance with an expected CAGR of 12.5% by 2030 and neobanking with an expected CAGR of 50.4% by 2026.

ETBFSI

Published On Jan 10, 2022 at 08:00 AM IST

See more on:

fintech,

indian fintechs,

mswipe,

fintechs,

blinc insights,

razorpay,

CRED,

Pinelabs,

Lendingkart

Telegram

Facebook

Copy Link

Comments

Source: BLinC InsightsDigital lending is expected to grow faster, with stricter regulations with an expected CAGR of approximately 33.5% by 2023, insurance with an expected CAGR of 12.5% by 2030 and neobanking with an expected CAGR of 50.4% by 2026.

ETBFSI

Published On Jan 10, 2022 at 08:00 AM IST

See more on:

fintech,

indian fintechs,

mswipe,

fintechs,

blinc insights,

razorpay,

CRED,

Pinelabs,

Lendingkart

Telegram

Facebook

Copy Link

Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

Post Find this Comment Offensive? Choose your reason below and click on the submit button. This will alert our moderators to take actions REASONS FOR REPORTING Join the community of 2M+ industry professionals. Subscribe to Newsletter to get latest insights & analysis in your inbox. All about ETBFSI industry right on your smartphone! Download the ETBFSI App and get the Realtime updates and Se your fourite articles.